Russia’s Shifting Maritime Logistics: The Case of LADY D and the Post-Syria Strategic Realignment

- RFN- OS

- Jun 11

- 4 min read

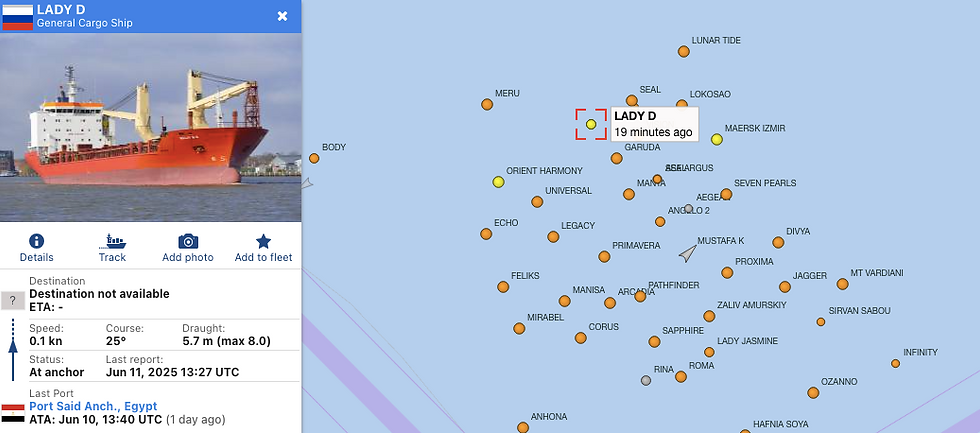

As Russia adapts to its declining presence in Syria, the logistical footprint of its maritime operations is evolving — and the case of the LADY D exemplifies this transformation. Currently stationary just north of Port Said, the sanctioned Russian-flagged merchant vessel, which departed the Baltic in late May 2025, presents a key indicator of how Moscow is reconfiguring its military and strategic supply chains across the broader Indo-Pacific axis.

Strategic Maritime Reach: Russia’s Indo-Pacific Logistics and Bilateral Access Points

As Russia recalibrates its maritime logistics following the diminishing viability of Tartus as a strategic hub, it is increasingly reliant on bilateral partnerships across the Indo-Pacific and South Asia to project operational endurance and maintain military-industrial outreach. These destinations serve both overt commercial and latent military functions, particularly in the context of circumventing Western sanctions and sustaining long-range deployments of sanctioned or dual-use cargo vessels.

Activity registered August 2023 - India area

🇮🇳 India

Strategic Profile: Longstanding defense partner

Key Ports: Mumbai, Visakhapatnam, Chennai

Objectives:

Technical support for Russian-supplied platforms (S-400, Talwar-class frigates, Ka-series helicopters)

Informal logistical access for Russian naval and merchant shipping

Ongoing cooperation in nuclear energy and defense industrial transfers

Naval interoperability via INDRA NAVY joint exercises

🇻🇳 Vietnam

Strategic Profile: Cold War-era ally with Russian-equipped naval forces

Key Ports: Cam Ranh Bay (historically used by Soviet Navy), Hai Phong

Objectives:

Depot-level maintenance for Russian-origin vessels and submarines

Resupply and technical exchanges under existing security agreements

Potential fallback maritime access node in the South China Sea

🇲🇲 Myanmar

Strategic Profile: Defense and counter-Western alignment

Key Ports: Yangon, Kyaukpyu

Objectives:

Delivery of Yak-130 aircraft, air defense systems, and ISR platforms

Military advisor presence and bilateral arms logistics

Unofficial maritime access under opaque port arrangements

🇮🇩 Indonesia

Strategic Profile: Non-aligned defense consumer with procurement interests

Key Ports: Surabaya, Tanjung Priok

Objectives:

Suspended arms procurement (e.g., Su-35) due to CAATSA constraints

Civilian port access for dual-use logistics under commercial pretext

Ongoing strategic dialogue within ASEAN-Russia framework

🇮🇷 Iran

Strategic Profile: High-level military-technological alliance

Key Ports: Bandar Abbas, Chabahar

Objectives:

Transfer hub for UAVs, precision munitions, and electronic warfare components

Joint naval drills with China and Russia

Critical node on Russia’s "Southern Corridor" to the Indian Ocean

🇨🇳 China

Strategic Profile: Top-tier strategic partner across economic and military dimensions

Key Ports: Shanghai, Qingdao, Guangzhou

Objectives:

Military-industrial cooperation and energy logistics

Dual-use transit for sanctioned cargo

Participation in coordinated maritime drills (e.g., Sea Interaction)

Strategic Implications:

With the erosion of Syria’s utility as a maritime logistics hub, Russia is now forced to extend the operational range of its merchant and auxiliary fleets. This shift necessitates enhanced blue-water logistics autonomy, including ship-to-ship refueling, offshore staging, and reliance on partner-state port access—some overt, some unofficial. These Indo-Pacific nodes represent the Kremlin’s evolving logistics doctrine, emphasizing resilience, dispersion, and global engagement through flexible bilateral corridors.

LADY D Off Port Said: Russia’s Post-Syria Shift

Initially assessed to be en route to Tartus — Russia’s long-standing naval logistics hub in Syria — the LADY D now appears to have bypassed the Levant entirely. Instead, OSINT and AIS data suggest a probable onward passage through the Suez Canal, with likely destinations being India, China, or Southeast Asian nations. This represents a significant shift in vector for Russian military maritime logistics, which traditionally operated on shorter loops within the Mediterranean theater under the protective umbrella of the Syrian corridor.

Notably, LADY D is currently anchored among several tankers in a known offshore transfer zone, north of the Suez approach.

This pattern is consistent with previous Russian-flagged logistics vessels such as MV Ascalon and MV Maia-1, which engaged in ship-to-ship (STS) operations to extend range and operational endurance — a standard yet strategically meaningful procedure. These STS refueling or resupply maneuvers enable Russian ships to sustain longer transits without port calls, minimizing exposure to international monitoring and port state controls.

The move away from Tartus is not a routine deviation. With the weakening of Bashar al-Assad’s regime and Moscow’s progressive military drawdown in Syria, Russia can no longer rely on the Levant as a logistics node for its military presence in the Mediterranean and broader MENA region. As a result, ships like LADY D now face extended deployments, requiring robust sustainment capabilities and coordination across partner ports or neutral logistical corridors.

What this means strategically is twofold:

Russia is recalibrating its naval logistics to project power eastward, toward Asia-Pacific partners — a move that fits with broader diplomatic efforts aimed at deepening ties with India, China, and ASEAN-aligned states.

The absence of a Mediterranean hub stretches Russia’s naval logistics, reducing operational efficiency and increasing dependence on extended blue-water supply lines and non-traditional support methods such as STS fueling and offshore coordination.

While such long-haul transits might appear standard, the implications for regional security architecture are clear. Russia is adapting — not retreating — and the LADY D is evidence of an increasingly globalized, adaptive maritime logistics strategy. As Western navies and analysts continue to monitor Russian fleet and merchant movements, understanding the logistical adaptations post-Syria is critical to anticipating Moscow’s next strategic plays.

Comments